So, what is an Innovative Company?

Innovative companies and their leaders share in common a willingness to challenge conventional thinking and believe that there are better ways of doing things.

They identify a need in the market that’s currently not being met by listening to their customers rather than following the competition and grab the opportunity with both hands.

Importantly, they are willing to invest the time, energy and money required to make their business “best in class”.

Innovative companies are more likely to be investing in targeted Research and Development (R&D) and marketing to explain their original concept to customers and the rest of the World.

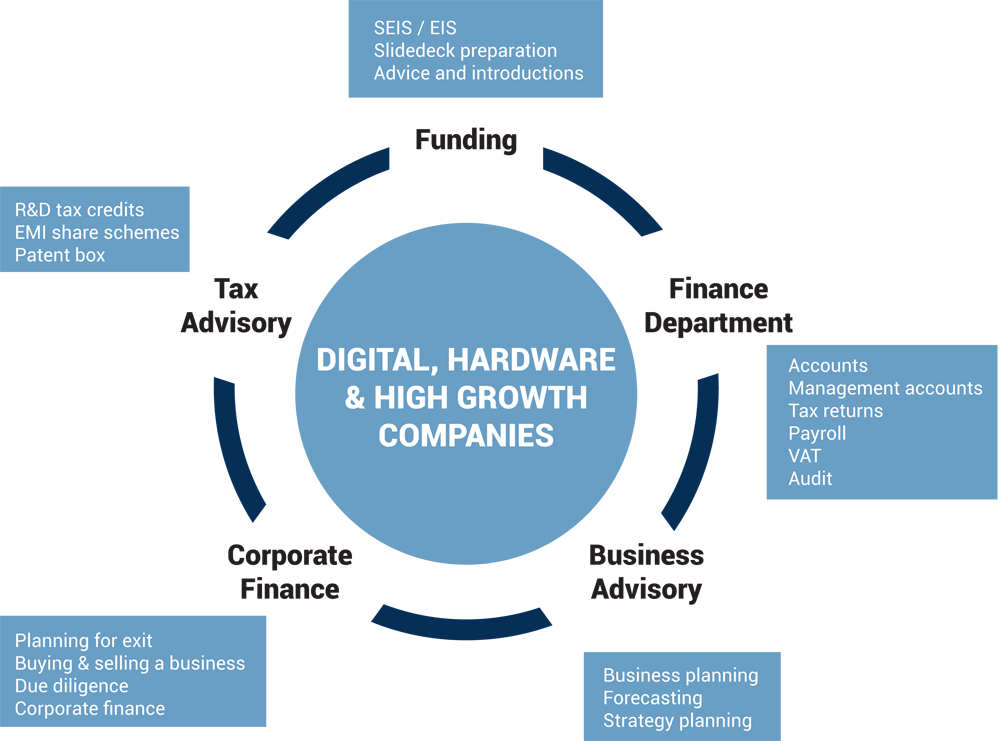

At Metric, we share those ideals, which is why we choose to focus solely on helping these companies.

Great firm. With been with them for over 3 years now, since the day we created the Company. Throughout they’ve been amazing.

I approached Metric to help us set up our first business. As a start-up it’s difficult to know what to do, where to go and who to trust. Years later, we are still using Metric and class them as an integral part of our business. They are a trusted adviser and I would highly recommend their services.

Metric Accountants has been supporting the Company for the past few years. The team is very competent and understands the requirements of a tech business well. They will take all the SEIS/EIS/VAT/R&D/accounts issues off your mind so that you can focus on running your own business. They are also just lovely people to work with. I could not recommend more.

Excellent, helpful, friendly and professional with competitive fees. Would highly recommend!

Metric are fabulous business partners. They are a true extension of the team. Beyond a great service, they are true advisors.

Metric Accountants have supported us from the founding of our company, helping us through several years of growth. They’re always available at the end of the phone and represent really excellent value for money. Choosing Metric was one of the best decisions I made!